There are some unnecessary purchases that we make and end up spending huge chunks on things that do not even add value to our life. Two years back I was in the same situation. I used to spend more than I earn.

I spent hours thinking about where all my hard-earned money was going. I made a list of items I used to spend my money on. I realized that it was those small things that together add up to our spending.

So, in this article, I am going to write about how to save money fast.

Once you have developed a habit of spending too much, it is a very daunting task to get fully rid of the habit all of a sudden.

Disclosure: This post may contain affiliate links. Please read our disclosure policy for more information.

How To Save Money Fast:

Here’s how I reduced my expenses by following these simple steps:

1. Automate your savings with Chime:

Automating your savings is the number one way to save money fast.

Chime’s automatic savings might help you to save more money.

When you make a purchase with your Chime Visa debit card, they will round up the transaction amount to the nearest dollar. They will transfer the roundup from your spending account to your savings account.

You will be able to save money on a regular basis without having to think about it! How cool is that?!

Also, if you haven’t heard of Chime before, here is a short and compact guide on how it can help you:

Chime:

Chime is an award-winning financial app and debit card that helps in managing, saving and spending money.

Chime’s mission is to make financial peace of mind a reality for all Americans. Make your money work harder for you with Chime’s optional savings account. It’s like putting your savings on autopilot.

All you have to do is to set up a spending account and you’re ready to enroll.

Chime offers a fee-free overdraft on up to 200 dollars of all debit card purchases.

Chime has no overdraft fees or foreign transaction fees, monthly service fees or transfer fees.

They also have thousands of fee-free in-network ATMs. You will be able to pay instantly to anyone even if they are not on Chime.

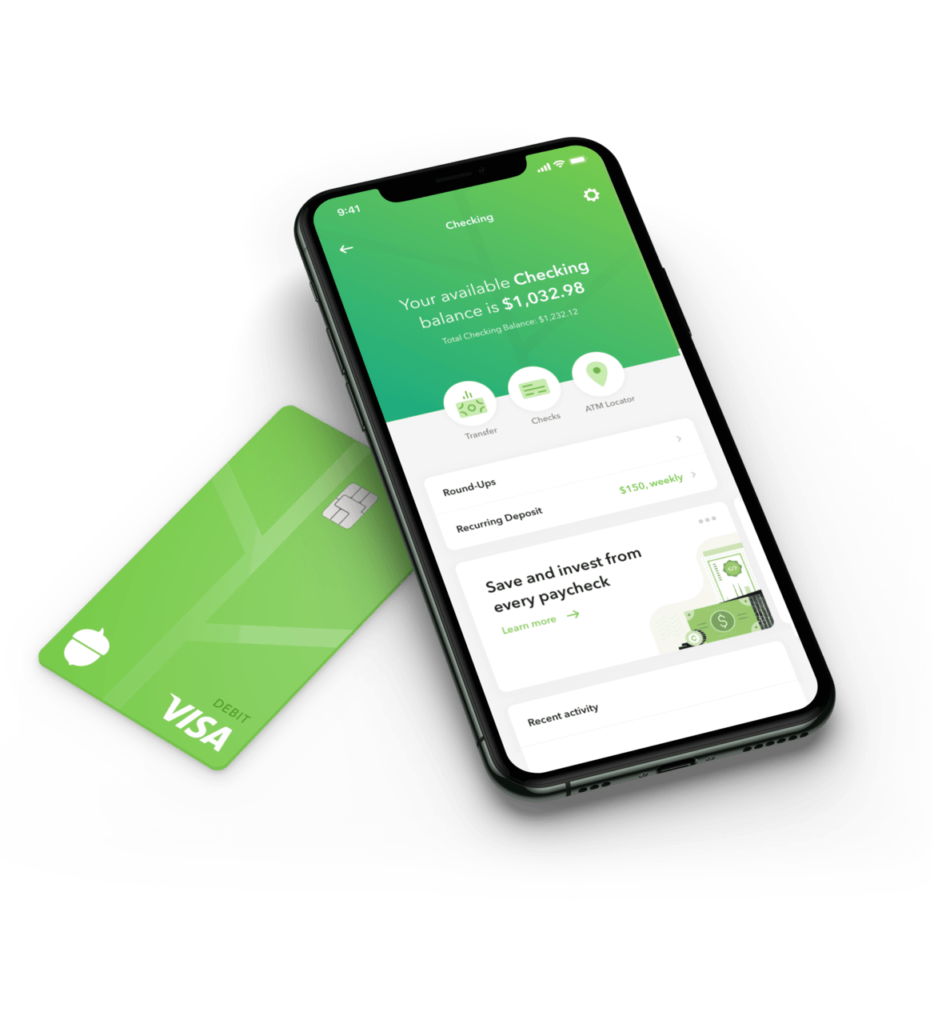

2. Invest your spare change with Acorns:

Acorns round up the spare change from everyday purchases to the nearest dollar and move the difference from a checking account into an Acorns investment account. That money is automatically invested into a diversified portfolio.

Acorns make it easier to invest on a regular basis with tools like round-ups and recurring deposits.

Acorns portfolios are made up of several exchange-traded funds (ETFs), that include a diverse mix of investments with the goal of providing a smoother and stable ride for your portfolio.

Each Acorns portfolio is made up of six different ETFs ( an ETF is a collection of stocks or bonds ).

This helps you to set aside cash for retirement automatically.

3. Have A High Yield Savings Account:

Having a savings account is a great way to generate passive income.

However, most banks across the world offer very low rates for a savings account.

CIT Bank is a banking application that offers high savings interest rates. Plus, there are no account opening or maintenance fees.

You need to deposit a minimum of $100 to open an account.

If you are getting started with saving money and generating passive income, CIT Bank would be the best option for you.

4. Save money on your cell phone plan:

Stop spending hundreds of dollars on your cell phone plan every month.

Tello Mobile offers some crazy affordable prices starting at $5 per month.

I was paying $100 a month for my cellphone plan until I heard about Tello. I was able to cut down my bill by half with their affordable price.

With just $39/month they offer unlimited data and text plans.

Moreover, they don’t have any activation or maintenance fees. There are no contracts and you can cancel anytime.

5. Save Money On Groceries:

A huge part of our income is spent on groceries every month. In order to save money on groceries, meal planning is very essential. Sit at least once a week and plan your meals for the whole week.

In order to make the work easier, you can check out this $5 Meal Plan. For just $5 a month, they will provide you with delicious meal plans that cost about $2 per person!

You can sign up for the 14-day trial here. If you don’t like it, you can cancel anytime you want to.

6. Save Money On Shopping:

Are you spending too much money on shopping?

Use the Drop app to save money on shopping. Whether you are ordering food from Postmates or reserving flights, you can shop directly from the Drop app. You will earn points for every purchase you make. You can then redeem your points at places like Amazon, Netflix or Starbucks.

TopCashback is another cashback site where you can join for free, shop at your favorite stores and earn cashback. The best part is that you can get the money directly in your bank account. Else you can also get your money in your PayPal account or in the form of gift cards.

Also, check out Rakuten (formerly known as Ebates) to get cashback on shopping. Rakuten(formerly Ebates) provides 1% to 10% cashback on your online shopping. It has over 700 retailers including Amazon, Sephora, Kohl’s, Target, and many others.

7. Cosmetics Are Costly:

If you are a girl you are most likely to spend money on makeup and cosmetics on a daily basis. I understand, makeup is important but don’t spend too much on it. Because using too many beauty products can also harm your skin in the long run. Instead, go for natural products that suit your skin.

In fact, natural ingredients can do wonders for your skin. Organic products are perfect for those who don’t want to spend $50 on a face mask. Nah! Those costly face masks don’t make your skin perfect!

8. Get Free Starbucks Coffee:

Having coffee outside twice a day quickly adds up to your spending. Instead, make yourself a coffee at home.

However, you can have FREE Starbucks coffee once in a while, by getting FREE gift cards from Swagbucks. You have to sign up and answer surveys to get free gift cards and PayPal cash from Swagbucks.

9. Cancel Gym Membership:

Some of us take costly gym memberships and never use them or use them very rarely. You can cancel your gym subscription and do work out at home too. Trust me, it is equally effective if you work with dedication.

10. Use Swagbucks For Gift Cards:

Swagbucks is an online survey website that offers gift cards every time you take part in a survey. You can also win gift cards by watching videos or just by searching the web.

How does it work?

Every time you answer surveys or watch videos on Swagbucks, you earn points. You can then redeem your points for free gift cards(Amazon, Walmart, etc) or get cash back from PayPal.

Join Swagbucks today for free.

11. Save Money Using Trim App:

Trim helps to negotiate your cable or internet bills and also cancels any unused subscriptions for you.

All you need to do is to download the app and share some basic bill information.

So far, Trim has helped its users to save over $40 million by taking care of their day-to-day finances.

12. Stop Using Cable TV:

I canceled my cable TV subscription. I use Hulu to watch TV shows and movies. It is cheap plus it has most of the entertaining shows and movies.

13. Stop Going To Theatres For Movies:

There are many people who go out to the movies every weekend. I used to do that too. I couldn’t just wait for that favorite release to be on TV or Netflix. I simply used to go to the movie theatres to watch my favorite film.

However, I have stopped going to the movie theatres now. I watch what is available on Netflix and Hulu. This will save you hundreds of dollars.

14. Use Cash( and not credit cards!)

Using cash in the store helps you to save money. While going out shopping, take a particular amount in hand that you decide to spend. This will restrict you from buying more than you need and purchasing unnecessary things that are not on your shopping list!

15. Eating out in restaurants too often:

Every time you feel hungry, first search for food at home, which is healthier. Also, there are times when friends request dining out together. But if you are running short of money, learn to say “NO” to them!

Else, if you really want to eat out, use Groupon to reduce your spending.

16. Shop online for FREE!

Yup! You read that right!

If you are not using Rebaid, you are leaving a lot of money on the table.

Shop from your favorite stores like Amazon, Target, Walmart, eBay and get deals up to 100% off!

Most products have 50-80% cash back but you can also find products that are totally free after rebate.

Moreover, I purchased a $19 sunglass for free!

Founded by Brendon Fields in 2019, Rebaid has a rating of 4.7 on Trustpilot.

17. Unsubscribe from emails:

If you are a person who loves shopping, you better unsubscribe your email from all the coupon sites or discount emails. The discount emails in your inbox make you buy things that you don’t even need. Whenever we see a discount, we have a tendency to buy everything which is at a discount.

We feel like we are saving our money. But in reality, we end up spending more.

18. Find out what triggers you to spend so much:

Firstly, find out the reason why you spend so much. From my personal experience, I have some friends who are always like “You have done good in your last exam. Give us a treat!” or “Congrats. Give us a treat as you got selected for the job interview!”. And I had a bad quality of not knowing how to say “NO” straight on their face. So, if you have such friends in your life who ask you to give them treats for literally everything happening in life, you better know how to say “No”.

19. Too Many Online Subscriptions:

Are you paying for multiple subscriptions(like Amazon Prime, Netflix, etc. ) at the same time? Are you even watching all of them? My suggestion would be to keep only one subscription at a time.

Final Thoughts On How To Save Money Fast:

Stopping yourself from spending money on unnecessary things might be a very challenging task but not impossible. However, gifting yourself once in a while won’t cost you too much.

Here’s how you can stop spending money on unnecessary things and save money fast. What do you do to save money fast? Share this article with the ones who need it.